Unlock Global Payment Success with Paystar Gateway

Paystar's payment gateway delivers effortless online payments with easy integration, instant onboarding, and a smart checkout.Envision seamless connections with your global customer base.

Our Features:

-

Universal Payment Acceptance

Accept 20+ global currencies including all major African ones (NGN, GHS) transfers, and flexible installments.

-

Developer-Centric Integration

Build faster with clean REST APIs and SDKs for all major languages. Pre-built plugins for WooCommerce, Magento, and custom platforms ensure rapid deployment.

-

Military-Grade Security

PCI DSS Level 1 certified with end-to-end encryption. Our AI-powered fraud detection blocks suspicious transactions in real-time, protecting your business 24/7.

Effortless Developer Integration

Integrate payments in minutes. Access well-documented SDKs, RESTful APIs, and one-click plugins for every major platform – all designed for effortless implementation. A payment gateway truly made for developers.

A world of payment methods at your fingertips

Enable 50+ local/global payment methods and 20+ currencies across Africa.

Seamlessly connect to millions of consumers with one integration.

Payment links

Accept payments in seconds by creating and sharing a simple payment link via email, SMS, or WhatsApp, with support for over 100 payment methods.

Benefits with Customisable Payment Links

How it works

Create in 30s

Generate payment links instantly on your dashboard – no code needed.

Share Anywhere

Send via WhatsApp, SMS, or social media (Twitter/Instagram DM supported).

Collect & Convert

Accept 20+ African currencies, get settled in USD/EUR/GBP within minutes.

Payment link integration made effortless

Personalize

Customise your payment page to match your brand, right from your dashboard.

100+ Payment Methods

Accept cards, UPI, wallets, and more—capture every sale.

Automation

Create and collect payments automatically via smart APIs.

Bulk Links

Generate hundreds of payment links at once by uploading a spreadsheet (.csv/.xlsx).

Pay bills across Africa instantly and securely

Access direct local payment methods like MTN Mobile Money, Airtel Money, M-PESA, and 50+ banks—covering 90% of African transactions. Our licensed, PCI DSS-compliant platform with real-time fraud protection ensures safety across 10+ markets, while enabling instant settlement of electricity, water, and telecom bills with zero delays.

Our features:

Direct Local Payment Access

MTN/Airtel Money/M-PESA and 50+ banks—Powering 90% African transactions

Africa-Compliant Security

Licensed in 10+ African markets • PCI DSS encrypted • Real-time fraud blocking

Instant Bill Payments

Settle electricity, water & telecom bills instantly – 0 queues, 0 delays

A world of payment methods at your fingertips

Enable 50+ local/global payment methods and 20+ currencies across Africa.

Seamlessly connect to millions of consumers with one integration.

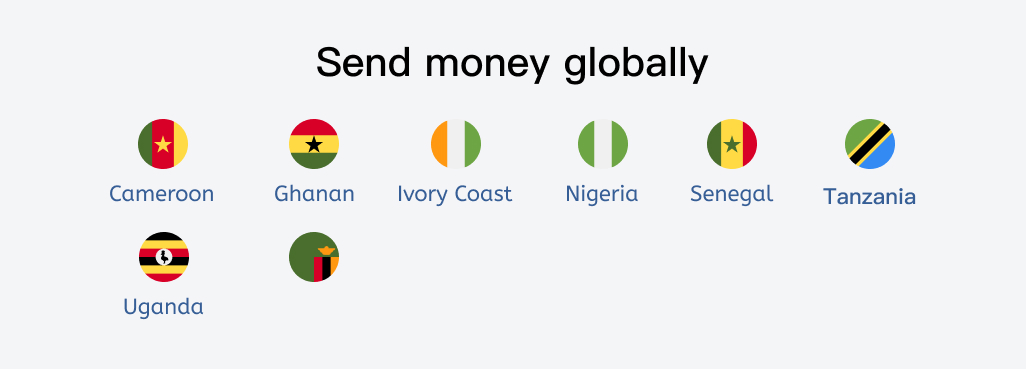

Aceppt payment globally

Do business anywhere in the world with seamless payments. Join thousands of businesses already using Paystar.

Build your business without borders

Support for major currencies

Accept payments from more than 100 currencies from around the world.

Real-time conversion

Get foreign currencies converted to local currency at the time of the transactions.

Easy setup

Set up your account in minutes with seamless onboarding to get your business moving. dummy text of the printing and typesetting industry.

Pay and get paid instantly

Send and receive money across 50+ countries effortlessly, with lightning-fast transfers built to keep your business moving.

Expanding your business worldwide

Partner with Paystar – the payments experts dedicated to your global success. Equip your business with cutting-edge international payment infrastructure trusted by borderless enterprises.

Accept payments in 100+ currencies with real-time conversion, enabling seamless transactions from every corner of the world.

Simplify your payroll

Automate salary payments and statutory filings like PAYE & NSSF with precision, all in one place.

Our Features:

-

Automated Tax Filing and Payment

Automatically calculates employee deductions such as PAYE, NSSF, and WCF, ensuring both accuracy and compliance.

-

Automated Payroll Process

We ensure your employees are paid accurately and on time, every time, following a payroll schedulecustomized to your needs.

-

Payroll Report

Effortlessly generate detailed payroll reports and payslips for every employee. Empower your accounting team with accurate data for seamless reconciliation and precise cost analysis..

One provider, one system, multiple countries

Whether you have a local entity or not, we help you:

-

Pay your team in local or foreign currency

-

File all statutory contributions on time

-

Meet country-specific tax and labour regulations

-

Avoid fines, disputes, or costly payroll errors

How Paystar Payroll Works

Create Your Company Account

Sign up free in 2 minutes—enter basic business details for instant access.

Onboard Workforce in Bulk

Upload employee lists via CSV/Excel or enable self-onboarding with invite links.

Review & Approve

Verify salaries, taxes, and benefits in the live dashboard. Edit anytime before processing.

Pay and get paid instantly

Initiate payments globally—automated tax filings and payslips generated instantly.

Easily Manage Your Point of Sale Setup

Paystar's feature-rich POS platform combines power and simplicity, helping businesses increase revenue, reduce admin, and delight guests.

Our Features:

-

Simple for Staff

Get your team up to speed fast using a POS that's easy for everyone—perfect for training casual staff quickly.

-

Increase Revenue

Specialize in upsells, cross-sells, and add-ons with a system built to maximize your selling opportunities.

-

Unlock Business Insights

Turn your POS into a robust data hub using reporting features designed to help you improve your business

Example of POS Transaction

Retail Store Purchase

At a retail clothing store, a customer purchases an item. The cashier scans it with a POS machine, processes the payment via card or mobile, and instantly completes the transaction—generating an electronic receipt.

Restaurant Billing

After dining, a customer asks for the bill. Using a POS terminal, the server quickly processes card or mobile payments—simplifying transactions and improving restaurant efficiency.

E-commerce Platforms

For online purchases, payments are processed via a virtual POS. Customers securely input card details or select digital payment methods, ensuring seamless and protected transactions for e-commerce retailers through system integration.

Service Industry

When paying for salon services, customers complete transactions at checkout counters through POS terminals—making payments efficient and effortless.

Return and Refund Transactions

POS systems efficiently manage returns and refunds. For example, when returning shoes to a footwear store, a cashier scans the receipt and processes the refund via POS. The transaction is instantly reversed, crediting the original payment method (e.g., credit card), while inventory automatically updates to reflect the returned item.